On the other hand, the quick ratio will show much lower results for companies that rely heavily on inventory since that isn’t included in the calculation. A high ratio can indicate that the company is not effectively utilizing its assets. For example, companies could invest that money or use it for research and development, promoting longer-term growth, rather than holding a large amount of liquid assets.

How to calculate current assets

These include cash and short-term securities that your business can quickly sell and convert into cash, like treasury bills, short-term government bonds, and money market funds. Your ability to pay them is called “liquidity,” and liquidity is one of the first things that accountants and investors will look at when assessing the health of your business. As a general rule of thumb, a current ratio in the range of 1.5 to 3.0 is considered healthy. Often, the current ratio tends to also be a useful proxy for how efficient the company is at working capital management. Healthcare providers face cash flow delays due to insurance reimbursements and fluctuating patient volumes. Professional services firms rely on accounts receivable rather than inventory.

Decrease In Current Assets – Common Reasons for a Decrease in a Company’s Current Ratio

Let’s look at some examples of companies with high and low current ratios. You can find these numbers on a company’s balance sheet under total current assets and total current liabilities. Some finance sites also give you the ratio in a list with other common financials, such as valuation, profitability and capitalization. The current ratio is a metric used by accountants and finance professionals to understand a company’s financial health at any given moment.

Example 1: Company A

For instance, if a company’s Current Ratio was 2 last year but is 1.5 this year, it may suggest that its liquidity has slightly decreased, which could be a cause for further investigation. The volume and frequency of trading activities have high impact on the entities’ working capital position and hence on their current ratio number. Many entities have varying trading activities throughout the year due to the nature of industry they belong.

The current ratio does not provide information about a company’s cash flow, which is critical for assessing its ability to pay its debts as they become due. As a general rule of thumb, a current ratio between 1.2 and 2 is considered good. This means that a company has at least $1.20 in current assets for every $1 in current liabilities, but no more than $2 in current assets for every $1 in current liabilities. However, it is essential to note that a trend of increasing current ratios may not always be positive.

Is there any other context you can provide?

- This means that Company A has $2 in current assets for every $1 in current liabilities, indicating that it can pay its short-term debts and obligations.

- If a company’s current ratio is too high, it may indicate it is not using its assets efficiently.

- For example, a declining current ratio could indicate deteriorating liquidity, while an increasing current ratio could indicate improved liquidity.

- A strong Current Ratio can instill confidence in potential investors, but it should be evaluated alongside other financial metrics and the company’s specific circumstances.

Current assets include cash, accounts receivable, and inventory, while current liabilities include accounts payable and short-term debt. While Company D has a lower current ratio than Company C, it may not necessarily be in worse financial health. The retail industry typically has high inventory levels, which can increase a company’s current assets and current ratio. Therefore, it is essential to consider the industry in which a company operates when evaluating its current ratio.

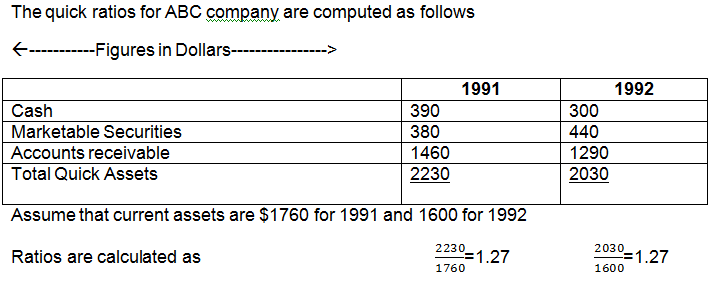

In this scenario, the company would have a current ratio of 1.5, calculated by dividing its current assets ($150,000) by its current liabilities ($100,000). The cash asset ratio, or cash ratio, also is similar to the current ratio, but it only compares a company’s marketable securities and cash to its current liabilities. On the other hand, the quick ratio is calculated by subtracting inventory from current assets and dividing the result by current liabilities. The quick ratio is considered a more conservative measure of a company’s ability to meet its short-term obligations. For example, the quick ratio is another financial metric that measures a company’s ability to meet its short-term obligations. Still, it only includes assets that can be quickly converted to cash, such as cash and accounts receivable.

Investors often use the Current Ratio to gauge a company’s financial stability and its ability to weather economic downturns. A strong Current Ratio can instill confidence in potential investors, but it should be evaluated alongside other financial metrics and the company’s specific circumstances. To compare the current ratio of two companies, it is necessary that both of them use the same inventory valuation method.

Suppose we’re tasked with analyzing the liquidity of a company with the following balance sheet data in Year 1. The current ratio is most useful when measured over time, compared against a competitor, or compared against a benchmark. Apple technically did not have enough current assets on hand to pay all of its short-term bills. A current ratio of less than 1.00 may seem alarming, but a single ratio doesn’t always offer a complete picture of a company’s finances. Modern financial technology (such as Sage Intacct) boosts the speed and accuracy of quick ratio analysis, supporting agile financial management.

However, similar to the example we used above, special circumstances can negatively affect the current ratio in a healthy company. For instance, imagine Company XYZ, which has a large receivable that is unlikely to be collected or excess inventory that may be obsolete. The prevailing view of what constitutes a “good” ratio has been changing in recent years, as more companies have looked to the future rather than just the current moment. Some lenders and investors have been looking for a 2-3 ratio, while others have said 1 to 1 is good enough.

However, it is important to consider the industry context and specific financial situation of a company before drawing conclusions. Working capital helps to identify potential financial issues and assess a company’s ability to meet its short-term obligations. Investors and analysts use the current ratio to assess a company’s 11 sample business plans to help you write your own financial health, as it reflects the capacity of the company to effectively handle its financial obligations. Furthermore, the higher the current ratio, the stronger the company’s liquidity position becomes, while a lower ratio indicates potential difficulty in meeting its short-term financial obligations.