A current ratio lower than the industry average could mean the company is at risk for default, and in general, is a riskier investment. For example, a company’s current ratio may appear to be good, when in fact it has fallen over time, indicating a deteriorating financial condition. But a too-high current ratio may indicate that a company is not investing effectively, leaving too much unused cash on its balance sheet. Because inventory levels vary widely across industries, in theory, this ratio should give us a better reading of a company’s liquidity than the current ratio. A company with a current ratio of less than one doesn’t have enough current assets to cover its current financial obligations. Companies may use days sales outstanding to better understand how long it takes for a company to collect payments after credit sales have been made.

Current Ratio vs. Other Liquidity Ratios

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. Learn more about Bench, our mission, and the dedicated team behind your financial success.

Nature of the Business – How Does the Industry in Which a Company Operates Affect Its Current Ratio?

- If you have too much cash tied up in inventory, you may not have enough short-term liquidity to operate the business.

- The current ratio is 2.75 which means the company’s currents assets are 2.75 times more than its current liabilities.

- For example, let’s say that Company F is looking to obtain a loan from a bank.

- If the company is not generating enough revenue to cover its short-term obligations, it may need to dip into its cash reserves, which can lower the current ratio.

- In contrast, the return on equity can provide insight into how effectively a company uses its assets to generate profits.

Current ratio is equal to total current assets divided by total current liabilities. The current ratio is a liquidity and efficiency ratio that measures a firm’s ability to pay off its short-term liabilities with its current assets. The current ratio is an important measure of liquidity because short-term liabilities are due within the next year. To calculate the ratio, analysts compare a company’s current assets to its current liabilities.

How Does the Industry in Which a Company Operates Affect Its Current Ratio?

If the company is not generating enough revenue to cover its short-term obligations, it may need to dip into its cash reserves, which can lower the current ratio. The current ratio assumes that the values of current assets are accurately stated in the financial statements. However, this may not always be the case, and inaccurate asset valuation can lead to misleading current ratio results. Investors and stakeholders can use the current ratio to make investment decisions. A company with a high current ratio may be considered a safer investment than one with a low current ratio, as it can better meet its short-term debt obligations. This means that Company A has $2 in current assets for every $1 in current liabilities, indicating that it can pay its short-term debts and obligations.

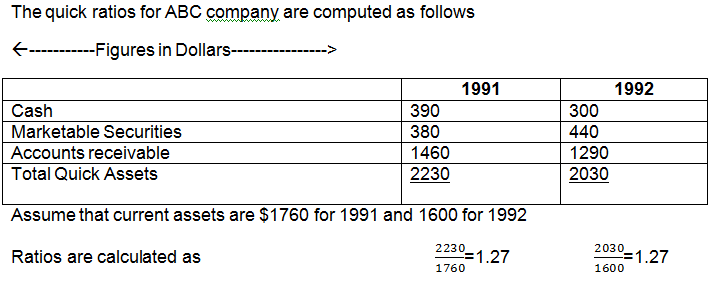

Liquidity comparison of two or more companies with same current ratio

A company with an increasing current ratio may hoard cash and not invest in future growth opportunities. Therefore, it is crucial to analyze the reasons behind the trend in the current ratio. Let’s look at examples of how the current ratio can be used to evaluate a company’s financial health. We’ll also explore why the current ratio is essential to investors and stakeholders, the limitations of using the current ratio, and factors to consider when analyzing a company’s current ratio. Generally, it is agreed that a current ratio of less than 1.0 may indicate insolvency.

The current liabilities of Company A and Company B are also very different. Company A has more accounts payable, while Company B has a greater amount in short-term notes payable. This would be worth more investigation because it is likely that the accounts payable will have to be paid before the entire balance of the notes-payable account. Company A also has fewer wages payable, which is the liability most likely to be paid in the short term. Finally, the operating cash flow ratio compares a company’s active cash flow from operating activities (CFO) to its current liabilities. This allows a company to better gauge funding capabilities by omitting implications created by accounting entries.

This slow, manual approach could lead to outdated insights, making relying on the quick ratio for real-time financial decision-making challenging. Generally, a quick ratio above 1.0 suggests that your company can comfortably meet its immediate obligations. This ratio reflects your business’s capacity to cover expenses, pay employees, and make necessary investments without delay. Business owners must focus on working capital, liquidity, and solvency so that their business can generate enough cash to operate. Managers should also monitor liquidity and solvency, and there are three additional ratios that can help you get the job done.

Larger companies may have a lower current ratio due to economies of scale and their ability to negotiate better payment terms with suppliers. If the business can produce the same $2,000,000 in sales with a $100,000 inventory investment, the ratio increases to 20. Turnover ratios determine how quickly a business can produce an asset (or buy it into inventory), sell an asset, and collect the cash payment. This list includes many of the common accounts in a business’s balance sheet. The following data has been extracted from the financial statements of two companies – company A and company B.

This means that Company B has $0.67 in current assets for every $1 in current liabilities, indicating that it may have difficulty paying its short-term debts and obligations. However, you have to know that a high value of the current ratio is not always good for investors. A disproportionately high current ratio may point out that the company uses its current assets inefficiently or doesn’t use the opportunities to gain capital from external short-term financing sources. If so, we could expect a considerable drawdown in future earnings reports (check the maximum drawdown calculator for more details).

Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions. Our team is ready to learn about your business and guide you to the right solution. Bench simplifies your small business accounting by combining intuitive software that automates the 7 best business debt management companies for 2021 the busywork with real, professional human support. By leaving a comment on this article, you consent to your comment being made publicly available and visible at the bottom of the article on this blog. For more information on how Sage uses and looks after your personal data and the data protection rights you have, please read our Privacy Policy.